WON: 35 pips

Using my One-Pip Range Trading Strategy + Forex Alerter I made 35 pips profit for last week.

No losses. Third week in a row with zero losses.

Let's see how this week fares.

Monday, February 25, 2008

Wednesday, February 20, 2008

Forex Tools - Alerter Revision 21

Forex Tools 1.0.0 (Revision 21) - Alerter :

Added a new combobox shown in red above. It enables user to select the interval for which to play the sound. Default is 10 seconds. Other options: 15,20,30 and 60 secs. Useful when you are sharing office space and don't want to annoy your colleagues with a sound every 10 seconds.

A non-distracting approach:

1. Lower your volume control

2. Use system sounds (instead of Coin and Cash Register sounds)

3. Select longer interval, eg 30 secs

Added a new combobox shown in red above. It enables user to select the interval for which to play the sound. Default is 10 seconds. Other options: 15,20,30 and 60 secs. Useful when you are sharing office space and don't want to annoy your colleagues with a sound every 10 seconds.

A non-distracting approach:

1. Lower your volume control

2. Use system sounds (instead of Coin and Cash Register sounds)

3. Select longer interval, eg 30 secs

Monday, February 18, 2008

Why is NY Forex Market closed on a Monday?

My OANDA Widget FXMarket Hours indicated that the New York Forex Market failed to open at 9pm (Feb 18) my country's time (GMT+8) and I wondered why? It should have opened, instead it indicated that it will only open tomorrow night (Feb 19).

I suspect a US Federal holiday perhaps? And so I checked and found this:

It's Washington's Birthday (Feb 18)- a Federal holiday in US.

This is the sort of thing one must watch out for. When a market is closed it will affect liquidity. Low liquidity is bad for Range Traders. The only market now opened is London which is due to close at in about 3 hours time i.e. at 1 am. Then from 1 am to 6 am (Sydney market opens), no market will be opened. This means liquidity will be very low from 1 am to 6 am and I should refrain from opening any positions.

In my country (GMT + 8), the Forex markets opens:

Sydney 6 am

Tokyo 8 am

London 3 pm

NY 9 pm

The period of highest liquidity is when London overlaps with NY, ie. from 9 pm to 12 midnight.

London and NY being the largest and second largest Forex markets respectively.

I recalled that the same thing happened in January 21 - also a Monday. At that time I was also perplexed at NY Forex failure to open. And upon checking, I also discovered that Jan 21 was Martin Luther King Jr's birthday - also a US Federal holiday.

I suspect a US Federal holiday perhaps? And so I checked and found this:

It's Washington's Birthday (Feb 18)- a Federal holiday in US.

This is the sort of thing one must watch out for. When a market is closed it will affect liquidity. Low liquidity is bad for Range Traders. The only market now opened is London which is due to close at in about 3 hours time i.e. at 1 am. Then from 1 am to 6 am (Sydney market opens), no market will be opened. This means liquidity will be very low from 1 am to 6 am and I should refrain from opening any positions.

In my country (GMT + 8), the Forex markets opens:

Sydney 6 am

Tokyo 8 am

London 3 pm

NY 9 pm

The period of highest liquidity is when London overlaps with NY, ie. from 9 pm to 12 midnight.

London and NY being the largest and second largest Forex markets respectively.

I recalled that the same thing happened in January 21 - also a Monday. At that time I was also perplexed at NY Forex failure to open. And upon checking, I also discovered that Jan 21 was Martin Luther King Jr's birthday - also a US Federal holiday.

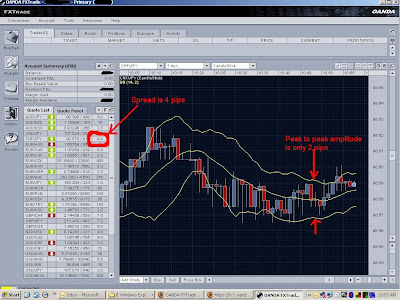

Do not trade Range when spread > peak-to-peak amplitude

Below is an example when you should not enter a Range trade:

Always check the Spread before entering a trade. In the above case, the spread for CHF-JPY is 4 pips - which is larger than the peak-to-peak amplitude of the Bollinger band. It is impossible to profit. In such a case, just be patient and wait for:

1. the Spread to decrease

2. the peak-to-peak amplitude to increase (meaning higher liquidity)

3. the Spread to be < the peak-to-peak amplitude

Always check the Spread before entering a trade. In the above case, the spread for CHF-JPY is 4 pips - which is larger than the peak-to-peak amplitude of the Bollinger band. It is impossible to profit. In such a case, just be patient and wait for:

1. the Spread to decrease

2. the peak-to-peak amplitude to increase (meaning higher liquidity)

3. the Spread to be < the peak-to-peak amplitude

Saturday, February 16, 2008

47 pips this week no losses

WON: 47 pips

Just using my One-Pip Range Trading Strategy and the Forex Tools - Alerter software, this week turned up yet a winner again with 47 pips and zero losses, beating last week's 36 pips win.

This trading system seems to be working.

Done for the week. It's early Saturday morning - 12.48 a.m. Going to bed....

Will continue trading Morning morning.

Just using my One-Pip Range Trading Strategy and the Forex Tools - Alerter software, this week turned up yet a winner again with 47 pips and zero losses, beating last week's 36 pips win.

This trading system seems to be working.

Done for the week. It's early Saturday morning - 12.48 a.m. Going to bed....

Will continue trading Morning morning.

Wednesday, February 13, 2008

Breakout always happens after Bollinger Band Compression

The screen shot below shows a compression at point A and followed by a breakout at point B:

I have seen this so many times that I felt it worthwhile to put up a screen shot above.

The astute Range Trader should never put his Limit Orders inside the compressed Bollinger Band. Instead, put it at the previous peak in the amplitude as shown by the small square on bottom right above.

I have seen this so many times that I felt it worthwhile to put up a screen shot above.

The astute Range Trader should never put his Limit Orders inside the compressed Bollinger Band. Instead, put it at the previous peak in the amplitude as shown by the small square on bottom right above.

Forex Tools 1.0.0.20 - OCR Enabled (Automater)

Started a new project - called Project Automater. Below is a screenshot of work-in-progress:

This will be my third addition to the Forex Tools Suite of tools. The first two were:

Stop Loss Calculator

Alerter

Automater can extract numbers, eg, SL, TP, Price, Current, Profits (USD), etc.. from the Oanda FXTrade Window. It does this by using OCR to recognize the numbers from Oanda's Java Application Window. I'm using the free MODI OCR library from Microsoft Office 2007.

Also included is AutoItX library - which is capable of automatically opening any window and clicking or entering text.

At the moment I have not yet come up with any definite use for the numbers extracted from the Oanda Window. Possible applications I can foresee is the ability to automatically do the following:

1. Open/Close Market Orders based on pre-set logic

2. Open/Close Limit Orders based on pre-set logic

3. modify Limit Orders based on pre-set logic

4. modify Stop Losses based on pre-set logic

5. sending SMS or email

6. updating a web page for remote retrieval from cell phones and PDA

7. Oanda Simulation - by storing the price movements for later re-play in a simulator window.

8. Speech synthesis - announcer - for announcing price movements, or, other alerts

I know that Oanda API could possibly do some of the above, but Oanda API does not come cheap, and is surely beyond my means. Hence, this project.

This will be my third addition to the Forex Tools Suite of tools. The first two were:

Stop Loss Calculator

Alerter

Automater can extract numbers, eg, SL, TP, Price, Current, Profits (USD), etc.. from the Oanda FXTrade Window. It does this by using OCR to recognize the numbers from Oanda's Java Application Window. I'm using the free MODI OCR library from Microsoft Office 2007.

Also included is AutoItX library - which is capable of automatically opening any window and clicking or entering text.

At the moment I have not yet come up with any definite use for the numbers extracted from the Oanda Window. Possible applications I can foresee is the ability to automatically do the following:

1. Open/Close Market Orders based on pre-set logic

2. Open/Close Limit Orders based on pre-set logic

3. modify Limit Orders based on pre-set logic

4. modify Stop Losses based on pre-set logic

5. sending SMS or email

6. updating a web page for remote retrieval from cell phones and PDA

7. Oanda Simulation - by storing the price movements for later re-play in a simulator window.

8. Speech synthesis - announcer - for announcing price movements, or, other alerts

I know that Oanda API could possibly do some of the above, but Oanda API does not come cheap, and is surely beyond my means. Hence, this project.

Sunday, February 10, 2008

AutoItX and OCR in C#

Nice references on Using AutoItX in C#

http://dau.shynd.com/forum/index.php?showtopic=955&mode=threaded&pid=12922

Accessing Java Applets using Java Access Bridge

http://java.sun.com/javase/technologies/accessibility/accessbridge/index.jsp#API_calls

OCR capture from Java Applet using MODI

http://www.codeproject.com/KB/office/modi.aspx

Free MODI OCR

http://weblogs.asp.net/jgalloway/archive/2006/10/01/Free-OCR-software_3F00_-You-may-already-have-it_2E002E002E00_.aspx

Misc

http://www.autoitscript.com/forum/index.php?showtopic=52853&st=0

http://www.autoitscript.com/forum/index.php?showtopic=50608

http://dau.shynd.com/forum/index.php?showtopic=955&mode=threaded&pid=12922

Accessing Java Applets using Java Access Bridge

http://java.sun.com/javase/technologies/accessibility/accessbridge/index.jsp#API_calls

OCR capture from Java Applet using MODI

http://www.codeproject.com/KB/office/modi.aspx

Free MODI OCR

http://weblogs.asp.net/jgalloway/archive/2006/10/01/Free-OCR-software_3F00_-You-may-already-have-it_2E002E002E00_.aspx

Misc

http://www.autoitscript.com/forum/index.php?showtopic=52853&st=0

http://www.autoitscript.com/forum/index.php?showtopic=50608

AutoIT Scripting

Learning up AutoIT Scripting Language. Planning to write automated scripts for OANDA later on once I have familiarized myself with this wonderful tool from:

http://www.autoitscript.com/autoit3/

Thanks to this post:

http://www.cyrox.com/forum/index.php?topic=152.0

Now, learning by practising.

Below is an AutoIT script I've written to start Winzip 111 installation and cancel it at the last stage:

Run("winzip111.exe")

WinWaitActive("WinZip® 11.1 Setup","&Setup")

Send("!S")

WinWaitActive("WinZip Setup - WinZip E-Mail Companion")

Send("!N");

Send("{ENTER}")

WinWaitActive("WinZip Setup - Carbonite's Online Backup Service")

Send("!N");

Send("{ENTER}")

WinWaitActive("WinZip 11.1 Setup","Installation Wizard")

Send("!N")

WinWaitActive("WinZip 11.1 Setup","accept the license agreement")

ControlClick("WinZip 11.1 Setup","accept the license agreement",1008)

WinWaitActive("WinZip 11.1 Setup","Installation is not complete")

Send("!E")

Some useful scripts

To call a java app:

Run("cmd.exe");open cmd

WinWaitActive("C:\WINDOWS\system32\cmd.exe");get a focus

Send("cd c:\javaProject {ENTER}");change dir

Send("javac something.java {ENTER}");compile java file

Send("java something {ENTER}");run java class

Send("exit {ENTER}");exit cmd

Other Strategy for java applets:

Get the coordinates of the associated EMBED or OBJECT tag and then click relative to its geometry. See the examples for _IEPropertyGet for a starter.

you can trigger off of pixel colors (PixelGetColor)... _IEPropertyGet will give you coordinates of an object you can use

can access the menus and click on certain points in the window using the mouse co-ordinates or by using Send("!f") {ENTER}

http://www.autoitscript.com/autoit3/

Thanks to this post:

http://www.cyrox.com/forum/index.php?topic=152.0

Now, learning by practising.

Below is an AutoIT script I've written to start Winzip 111 installation and cancel it at the last stage:

Run("winzip111.exe")

WinWaitActive("WinZip® 11.1 Setup","&Setup")

Send("!S")

WinWaitActive("WinZip Setup - WinZip E-Mail Companion")

Send("!N");

Send("{ENTER}")

WinWaitActive("WinZip Setup - Carbonite's Online Backup Service")

Send("!N");

Send("{ENTER}")

WinWaitActive("WinZip 11.1 Setup","Installation Wizard")

Send("!N")

WinWaitActive("WinZip 11.1 Setup","accept the license agreement")

ControlClick("WinZip 11.1 Setup","accept the license agreement",1008)

WinWaitActive("WinZip 11.1 Setup","Installation is not complete")

Send("!E")

Some useful scripts

To call a java app:

Run("cmd.exe");open cmd

WinWaitActive("C:\WINDOWS\system32\cmd.exe");get a focus

Send("cd c:\javaProject {ENTER}");change dir

Send("javac something.java {ENTER}");compile java file

Send("java something {ENTER}");run java class

Send("exit {ENTER}");exit cmd

Other Strategy for java applets:

Get the coordinates of the associated EMBED or OBJECT tag and then click relative to its geometry. See the examples for _IEPropertyGet for a starter.

you can trigger off of pixel colors (PixelGetColor)... _IEPropertyGet will give you coordinates of an object you can use

can access the menus and click on certain points in the window using the mouse co-ordinates or by using Send("!f") {ENTER}

Saturday, February 9, 2008

Newly Revised One-Pip Range Trading Strategy

Below is the newly revised Trading System I am currently using. I have reworded the entire paragraphs:

One-PIP Range Trading Strategy:

1. Look for a Ranging Pair for the Daily Chart and 1-minute Chart eg, CHF-JPY. This system works only for Ranging Pairs, not Trending Pairs. Any pair can become Trending or Ranging, so check with the daily chart to confirm.

2. In the daily chart if the price is in the upper band of the Bollinger bands, this means that the price will change direction by swinging down at anytime. As such, in the 1 min chart, you should enter a short at the inner edge of upper Bollinger band .

3. Enter Limit Orders for 1000 units to make the 1 pip TP's give better yield.

4. In the Limit Order, set TP at a distance of 1-pip from the limit order price.

5. Determine how much risk of loss you are willing to accept and convert it to pips. Then set the SL accordingly. For me, I am willing to risk USD10 loss on every trade and my SL is usually 100 pips away from my limit order price (for the CHF-JPY pair).

6. Ensure that the currency pair is highly volatile and liquid. If the Bollinger band becomes compressed, do not put your Limit Order inside the band, instead put it outside at the point of the upper peak (for Shorts) of the amplitude just before it became compressed. This is because a breakout always happens immediately after a compression. Also, take note of the Spread. A compressed Bollinger band's peak-to-peak Amplitude may be smaller than the spread.

7. Fire up Forex Tools and start the Alerter window. Set the color for the TP line and wait. Ocassionally adjust your Limit Order. Forex Tool-Alerter will alert you when a Limit Order has been fulfilled (via the appearance of a TP line). It will play the sound of a Cash Register, every 10 seconds. Once this happens, there is an opened position. Switch to the 1 hourly chart and bring both TP and SL lines into view.

8. Forex Tool-Alerter will now monitor the TP line. Once the TP (or SL ) line is hit, it will disappear and it will alert you by repeatedly playing the sound of a coin dropping into a coinbox, every 10 seconds.

9. Stop Forex Tool-Alerter and Repeat the process again from Step 1. If the Daily Chart indicates that the price is in the lower Bollinger band, this means that it will start to reverse direction by swinging upwards at anytime. You should then enter a long position in the inner edge of the lower Bollinger band for the 1-minute chart. The rest of the instructions remain the same.

Happy Trading

One-PIP Range Trading Strategy:

1. Look for a Ranging Pair for the Daily Chart and 1-minute Chart eg, CHF-JPY. This system works only for Ranging Pairs, not Trending Pairs. Any pair can become Trending or Ranging, so check with the daily chart to confirm.

2. In the daily chart if the price is in the upper band of the Bollinger bands, this means that the price will change direction by swinging down at anytime. As such, in the 1 min chart, you should enter a short at the inner edge of upper Bollinger band .

3. Enter Limit Orders for 1000 units to make the 1 pip TP's give better yield.

4. In the Limit Order, set TP at a distance of 1-pip from the limit order price.

5. Determine how much risk of loss you are willing to accept and convert it to pips. Then set the SL accordingly. For me, I am willing to risk USD10 loss on every trade and my SL is usually 100 pips away from my limit order price (for the CHF-JPY pair).

6. Ensure that the currency pair is highly volatile and liquid. If the Bollinger band becomes compressed, do not put your Limit Order inside the band, instead put it outside at the point of the upper peak (for Shorts) of the amplitude just before it became compressed. This is because a breakout always happens immediately after a compression. Also, take note of the Spread. A compressed Bollinger band's peak-to-peak Amplitude may be smaller than the spread.

7. Fire up Forex Tools and start the Alerter window. Set the color for the TP line and wait. Ocassionally adjust your Limit Order. Forex Tool-Alerter will alert you when a Limit Order has been fulfilled (via the appearance of a TP line). It will play the sound of a Cash Register, every 10 seconds. Once this happens, there is an opened position. Switch to the 1 hourly chart and bring both TP and SL lines into view.

8. Forex Tool-Alerter will now monitor the TP line. Once the TP (or SL ) line is hit, it will disappear and it will alert you by repeatedly playing the sound of a coin dropping into a coinbox, every 10 seconds.

9. Stop Forex Tool-Alerter and Repeat the process again from Step 1. If the Daily Chart indicates that the price is in the lower Bollinger band, this means that it will start to reverse direction by swinging upwards at anytime. You should then enter a long position in the inner edge of the lower Bollinger band for the 1-minute chart. The rest of the instructions remain the same.

Happy Trading

36 pips profits - Done for the week

WON: >36 pips

Zero losses.

Using the One-pip Range Trading Strategy and with the help of Forex Tool - Alerter, I won at least 36 pips for the week from about 36 trades.

It's late Friday night - nope early Saturday morning.

I'm done for the week - going to bed.

Will resume trading on Monday morning.

Zero losses.

Using the One-pip Range Trading Strategy and with the help of Forex Tool - Alerter, I won at least 36 pips for the week from about 36 trades.

It's late Friday night - nope early Saturday morning.

I'm done for the week - going to bed.

Will resume trading on Monday morning.

Friday, February 8, 2008

Released Forex Tools 1.0.0.19

Screen shot of Revision 19:

Made some changes to the Alerter Form:

1. Changed the coin.wav file because WinXP SP2 does not have codec to play the original coin.wav file. Now, it plays the sound of coin dropping into a coinbox when TP or SL line disappears. Also added System Sounds, i.e. Asterisk and Beep - in case Users wish to have a less distracting and telling sound (eg, when using this program in the office ;-) ).

2. Added a new GroupBox that allows User to preview the Sound Files.

3. Changed color selection algorithm, now User need not wait 3 seconds after pointing mouse in Picture Box. User can just point the mouse at the desired color in the Picture Box and click on it directly. The original algorithm caused a lag on slower machines (Celeron).

I've finally tested it on WinXP SP2. It works like a charm.

Tested on :

Vista (on Intel Core 2 Duo)

Vista (on AMD Turion Dual Core)

WinXP SP2 (on Celeron)

This program is written using Visual Studio 2005 using C#.

Made some changes to the Alerter Form:

1. Changed the coin.wav file because WinXP SP2 does not have codec to play the original coin.wav file. Now, it plays the sound of coin dropping into a coinbox when TP or SL line disappears. Also added System Sounds, i.e. Asterisk and Beep - in case Users wish to have a less distracting and telling sound (eg, when using this program in the office ;-) ).

2. Added a new GroupBox that allows User to preview the Sound Files.

3. Changed color selection algorithm, now User need not wait 3 seconds after pointing mouse in Picture Box. User can just point the mouse at the desired color in the Picture Box and click on it directly. The original algorithm caused a lag on slower machines (Celeron).

I've finally tested it on WinXP SP2. It works like a charm.

Tested on :

Vista (on Intel Core 2 Duo)

Vista (on AMD Turion Dual Core)

WinXP SP2 (on Celeron)

This program is written using Visual Studio 2005 using C#.

Released Forex Tools 1.0.0.16

Released Forex Tools Version 1.0.0.16.

This Revision 16 fixes some bugs on capturing java applet screenshots.

I have also added a new button called Oanda TP Color. This enables me to set the Take Profit color for the Oanda FXTrade Platform without having to Select.

I am quite happy with this software. It has helped me enter more trades - and thus more profits.

So far I have only tested this software on Vista. It should also work on WinXP - just need to install .NET Framework 2.0.

I might put this software up on my website:

http://www.hackingmagic.com

In the meantime, I will continue to harvest pips with it.

Presently my trading Strategy is:

1. Use the One-Pip Range Trading Strategy

(See Jan 31 blog on "The One-Pip Range Trading Strategy")

2. Use my Forex Tools 1 (the Alerter function)

No. 1 above enables me to choose the correct pair and to set the correct Limit Orders

No. 2 above alerts me whenever a Limit Order is fulfilled, or, if an order is already in place, to

alert of a Take Profit (or Stop Loss) hit.

Thursday, February 7, 2008

Completed my Forex Alerter Project

Completed the Forex Alerter Project - after about 2 days of intensive coding. I had actually started the project about 1 month ago. Above is the screen shot. I now use the program to automatically monitor my Stop Loss and Take Profit. All I need to do is select the window which I wish to monitor, in this case, it is the Oanda FxTrade Window. Then, select the Green Line (or Red Line) to monitor Take Profit. Then, click start.

The program will automatically monitor the Green Line and sound a specific sound (a Cash Register sound) every 10 seconds if the line is still present. Once the price hits the Take Profit (or Stop Loss), the Green line (and Red Line) disappears and the Program will then play a different sound (the sound of coins dropping into a moneybag)- to indicate that the Take Profit line is gone.

This way, I don't have to keep watching the monitor. I can either leave the PC on and do other things, or, minimize the Oanda FXTrade window (or send it to background) and do other tasks on my PC.

The program could also be used another way. Set a Limit Order, then click start. Every 10 seconds the program plays the Coin Dropping sound indicating that a Take Profit line has not appeared, meaning the Limit Order has not be fulfilled. Once the price hits the Limit Order price, a Take Profit Line will appear and the program will repeatedly play the cash register sound every 10 seconds.

This program is now in testing. So far it is working quite well.

Friday, February 1, 2008

Using Daily chart to predict M1 chart price movement

WON: 2 pips (1st trade)

WON: 1 pip (2nd trade)

Using One-pip Range Trading Strategy.

Trading the CHF-JPY pair, the daily chart indicates ranging with the price about to swing down from the upper Bollinger Band. This means that I should enter short position:

I then looked at the M1 chart and entered a Limit Sell on the upper Bollinger band.

About 1 minute after that the price hit my Limit Sell and a Short position was opened, and another 6 minutes later, the price hit my TP and I won 2 pips:

I immediately repeated the feat and won another 1 pip.

Have a splitting headache. It's Friday midnight- I'm done for the week. Will resume trading on Monday morning.

The One-pip Range Trading Strategy has made 13 wins this week, totalling 15 pips and seems to be working, whereas using Forex Killer was a tragedy - losing more than -40 pips.

WON: 1 pip (2nd trade)

Using One-pip Range Trading Strategy.

Trading the CHF-JPY pair, the daily chart indicates ranging with the price about to swing down from the upper Bollinger Band. This means that I should enter short position:

I then looked at the M1 chart and entered a Limit Sell on the upper Bollinger band.

About 1 minute after that the price hit my Limit Sell and a Short position was opened, and another 6 minutes later, the price hit my TP and I won 2 pips:

I immediately repeated the feat and won another 1 pip.

Have a splitting headache. It's Friday midnight- I'm done for the week. Will resume trading on Monday morning.

The One-pip Range Trading Strategy has made 13 wins this week, totalling 15 pips and seems to be working, whereas using Forex Killer was a tragedy - losing more than -40 pips.

2 Pips win after 23 hours

WON: 2 pips

Used the 1-pip Range Strategy. The daily chart indicates a downward swing. So, in the M1 chart, I shorted the CHF_JPY. The price went up instead and stayed up for 23 hours and finally come down and hit my TP. The strategy works. Price movement will enventually follow the daily range behaviour.

Used the 1-pip Range Strategy. The daily chart indicates a downward swing. So, in the M1 chart, I shorted the CHF_JPY. The price went up instead and stayed up for 23 hours and finally come down and hit my TP. The strategy works. Price movement will enventually follow the daily range behaviour.

CHY-JPY Range Trading Using Bollinger Band

Subscribe to:

Posts (Atom)